Exactly how an effective USDA mortgage varies than many other types of mortgage loans

- What’s an excellent USDA financing?

- How good USDA mortgage varies than other sorts of mortgages

- That is entitled to good USDA financing?

- Advantages and disadvantages regarding a great USDA financing

Insider’s pros select the right products in order to make smart choices with your currency (this is how). In some cases, i discovered a payment from your the couples, yet not, all of our opinions is actually our own. Conditions apply at offers listed on these pages.

- A great USDA Mortgage is actually for reasonable-to-modest money individuals exactly who get a property from inside the rural otherwise suburban United states.

- USDA loans don’t require people down-payment, but you will you prefer at least a great 640 credit score.

- Your house can get be eligible for a beneficial USDA mortgage if it’s into the a region with 20,100 or a lot fewer people.

- Policygenius can help you evaluate homeowner’s insurance policies to discover the right exposure for your requirements, from the correct price

What is actually a good USDA loan?

A good USDA loan is actually home financing backed by the us Company from Agriculture. It’s to have individuals which have low-to-modest earnings profile just who buy homes during the rural otherwise suburban parts.

- Guaranteed: This type is backed by the fresh USDA, and you pertain using a participating lender.

USDA Head funds is having lower-income consumers, and also you need certainly to fulfill stricter criteria. When anyone relate to a good USDA financing, most are dealing with an ensured mortgage, aka new USDA Rural Development Protected Casing Mortgage Program – which will be the sort of USDA mortgage we’re examining contained in this blog post.

With a good USDA mortgage, you can aquire cashadvanceamerica.net $100 loan a home without deposit. You ought to score a predetermined-speed financial; adjustable prices are not a choice.

A traditional loan is not guaranteed by government. A private bank, such as for example a bank or credit partnership, will provide you with the loan in the place of insurance about government. But you will get prefer a traditional mortgage backed by regulators-paid home loan people Federal national mortgage association or Freddie Mac computer. A conventional mortgage needs at least an effective 620 credit rating, an excellent thirty six% debt-to-money ratio, and step 3% to help you 10% to own an advance payment.

A national-supported financing is secured by the a federal company. For those who default for the home financing that is supported by government entities, brand new department pays the financial institution on your behalf. When a loan provider will give you a federal government-guaranteed mortgage, it is for instance the bank gets insurance policies on your own loan. It is simpler to be eligible for a government-backed mortgage than simply a traditional financial.

A good USDA Rural Development Guaranteed Casing Loan is a kind of government-supported mortgage, and that form you will find looser qualifications conditions.

Who is entitled to a USDA financing?

A lender looks at a couple factors to see whether your qualify to have a USDA financing: your house and your economic reputation.

Assets qualifications

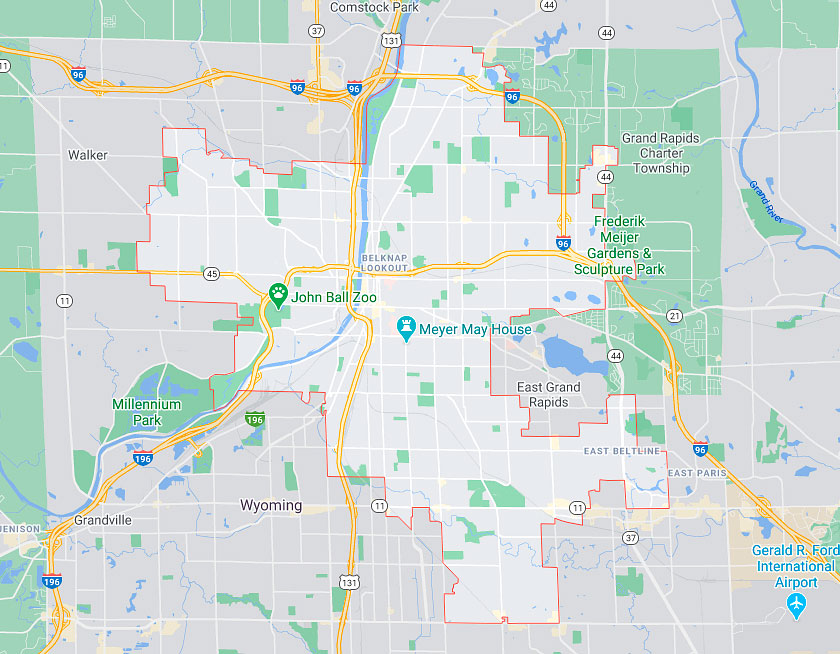

You are able to qualify for a great USDA mortgage when you’re buying a good home during the an outlying otherwise suburban urban area. The people restrictions was 20,000 for almost all areas and thirty-five,000 for other individuals.

For people who already know just the new target of the home you would like buying, enter the guidance to the USDA Possessions Eligibility Webpages. You will need to select which variety of USDA loan you’re curious during the, thus you can easily favor “Single Relatives Houses Guaranteed” if you need an ensured USDA loan.

Debtor qualifications

There isn’t any restrict credit limit. A loan provider often agree one borrow a specific amount established on your own financial profile.

Advantages and you will disadvantages regarding an excellent USDA mortgage

Good USDA mortgage would be a good fit for your requirements, as long as you’re alert to the potential trade-offs. Here you will find the good and the bad to getting this type of mortgage: